The second part of our series on how behavioural science can build understanding, empathy and connection with consumers in 2023, looks into how, with familiar reference points removed, people are struggling to navigate their costs and spending and what this means for marketers. If you haven't read part one yet, take a look here.

As prices rise on all fronts, we have lost our usual budgeting anchors and reference points. Some items have increased in price by 40% or more, whilst others have risen only a little. In the year 2022, the price of milk went up 45%, olive oil by 44%, pasta and potatoes 20%, rice 11%, chocolate 8%, fresh fruit 6%, air travel 18%. Many of our reference points are out of sync, meaning we are unable to work out what is relatively cheap and good value, what is expensive, what is worth buying, what we should stop buying, what we should replace it with and so on.

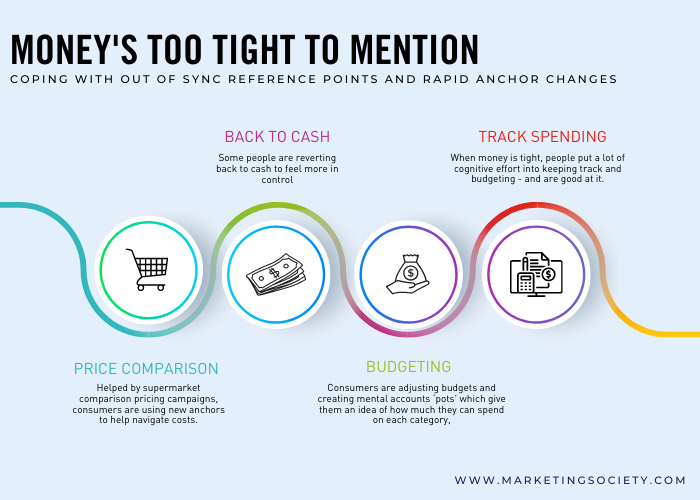

If we look at this challenge with a behavioural science lens, we can see that when people make decisions, they seek out familiar anchors or reference points and then adjust from them. But if these anchors change rapidly, people become disorientated, unable to use old reference points to make decisions about what to buy or know what is value for money. Budgeting becomes much harder and it is easier to make poor spending decisions.

Consumer Coping Strategies:

- Helped by supermarket comparison pricing campaigns, consumers are using new anchors to help navigate costs. Sainsbury’s Aldi Price Match, launched in 2021, has proved so successful that in January 2023 the range was expanded to 310 items. In February, Tesco added 50 more products to its Aldi Price Match, taking the total to 669 items.

- Consumers are adjusting budgets and creating mental accounts ‘pots’ which give them an idea of how much they can spend on each category, allowing separate amounts for rent or mortgage, food, commuting, bills, travel, and entertainment etc. The cost of living crisis is forcing people to reallocate money from one ‘pot’ to another. For example:

- Some individuals we have spoken to in our research said they increasingly walked or cycled to work to save money on transport. In fact, SORN applications reached their highest in October 2022, rising by 77% compared to the previous three months. A survey investigating the trend found that the main reason car owners cited for taking their car off the road was the rising cost of living.

- Average spend per head at restaurants has fallen from £25.38 to £21.80, whereas cafes and sandwich shops have seen a rise in spend from £6.05 to £6.69. People are more likely to meet friends for coffee than a full meal, or are ordering a main meal only. Separate research found that 34% of people are choosing cheaper food options and 25% are ordering fewer courses. Sharing platters have become more popular too.

- In the supermarkets, food baskets are smaller as people shop around to get the best deals from different supermarkets. Research by Barclays found 34% of consumers are shopping at multiple supermarkets to access a range of deals. In June Tesco reported that consumers were buying less per shop, yet shopping more frequently. Sainsbury’s has found shoppers are choosing cheaper products like frozen goods and own brand labels and buying only what they need to avoid waste, to help them manage their money throughout the month. People are also making more use of self-scanning technology to avoid ‘till shock’. Asda has observed people setting themselves £30 limits for food and fuel. Online grocery shopping is on the rise as many consumers feel it’s easier to control spending by taking items out of the basket if they spend more than they can afford. Shoppers are less conspicuous online too; no-one is watching them put items back, like they might do in-store.

- There is evidence of people pausing or cancelling subscriptions and memberships to save money, with things like Netflix, wine and gym memberships the first to go. One survey found that 10% of UK adults - young adults in particular - had either cancelled or were considering cancelling their gym membership. Research by KPMG found that 17% of people had cancelled media subscriptions, whilst 29% had used savings or borrowed to pay their subscriptions.

- Some people are reverting back to cash to feel more in control. During the pandemic it looked like cash was at death’s door. But in the last year people have actually reverted to cash payments, creating a partial recovery. For example, the number of ATM withdrawals dropped 40% from 44.5 million in 2019, to 26.4 million in 2020, but have gone back up to over 30 million in 2022. The Post Office reported that cash withdrawals were over £800m in July 2022, an 8% rise month-on-month, partially reversing the trend to no cash during the pandemic. In January, Nationwide reported a 19% increase in cash withdrawals from ATMs from 2021 to 2022, the first time in 13 years that there has been an increase in ATM use. And around 73% of consumers said they used cash in January 2022, a rise from only around 50% of consumers in mid-2020.

Simply put, cash helps people budget and keep their spending in check. A money.co.uk survey in April 2022 found that 42% of people say using cash helps them to stick to their budget and keep track of their spending. 65% said they spend more when they use their card or contactless payment device instead of cash.

- Insights from behavioural science have shown that cash payments can increase the ‘pain’ of physically parting with tangible notes, making people less likely to impulse buy and even forgo some purchases to make it through the month without going into the red. Cash also provides instant feedback on how much money you have left, unlike card payments which can take time to feed through into online balances.

- When money is tight, people put a lot of cognitive effort into keeping track and budgeting - and are good at it. Research shows that low income households are meticulous in calculating value for money. They track and memorise exact prices, will calculate unit prices and literally count the pennies. Our interviews have found that people use spreadsheets, track receipts and budget using a spread of bank accounts, all of which help them feel more in control. This means that playing to cognitive biases with offers and sales tactics may be less likely to work for them as they may have learnt to be wary of certain offers like BOGOF. Such offers may prompt them to make a conscious calculation and decision rather than automatically taking up the offer. And with the middle class squeezed as well, this group may also learn to think and budget in the same way.

Ideas and opportunities to build empathy, connection and support

Can you create anchors to help people navigate the new pricing? Iceland has stuck with its £1 deals even though they are making losses on half of them, as they feel it’s their ‘stake in the ground’, their price anchor for customers.

If you are communicating figures, or changes in prices, how can you make them more System 1 - cognitively easy? Which? has recommended that unit pricing, (e.g. price per 100g or per kg) is more transparent, so it’s easier to understand which items are genuinely good deals. The Competition and Markets Authority is looking into unit pricing practices online and instore in the groceries sector, stating that “It is important that shoppers who look at the prices of products should be able to compare like for like”, particularly in the context of the rising cost of living.

Are there ways you can help people keep track of their money and budget? Tools to allow better mental accounting or in context budget keeping?

Read the final part in this special three-part series here.

Written by Crawford Hollingworth, Liz Barker, Lucy Pilling and Katinka Duewel- The Behavioural Architects