In this three-part series from The Behavioural Architects, we look at how behavioural science can help build understanding, empathy and connection to the struggling consumer in 2023

‘Permacrisis’, a term that describes ‘an extended period of instability and insecurity’, was named Collins Dictionary word of the year 2022

The pandemic saw isolation, restriction, uncertainty and limited opportunities for spending. Coming out of the worst of the pandemic there was a brief period of heady enjoyment, fuelled by pent-up demand and savings burning holes in pockets. But, as 2022 went on, it became clear that consumers were facing another new challenge - a permacrisis as it has come to be known - meaning that brands must continue to pivot, stretch and squeeze in order to maintain or build traction and connection with consumers.

On a daily basis, consumers are having a tough time. The price of energy, food and fuel has soared in recent months and almost everyone is feeling the pinch.

Whilst a lucky few may be able to absorb those additional costs, the majority of the UK population is having to make trade-offs and sacrifices. In February, 84% of people surveyed said they ‘already feel they are living in a recession while ’NIESR say that 7 million UK households - that’s 1 in 4 - will be unable to cover in full their planned energy and food bills from their post-tax income in 2023-24. Added to this, a hugely concerning 11% (six million people) said that they were hungry but hadn’t eaten on a number of occasions in the past month because of lack of money (compared with 5% pre-pandemic).

The financial strain is undoubtedly increasing stress and anxiety levels too. Forecasts predict economic growth will be stagnant or even retracting during this year, whilst inflation is still high - Welcome to 2023!

In this article, we explore the impact of this disruptive reality and look at ways of connecting to and empathising with this new consumer. New needs may be emerging but it is challenging times such as these that prompt innovation and new thinking.

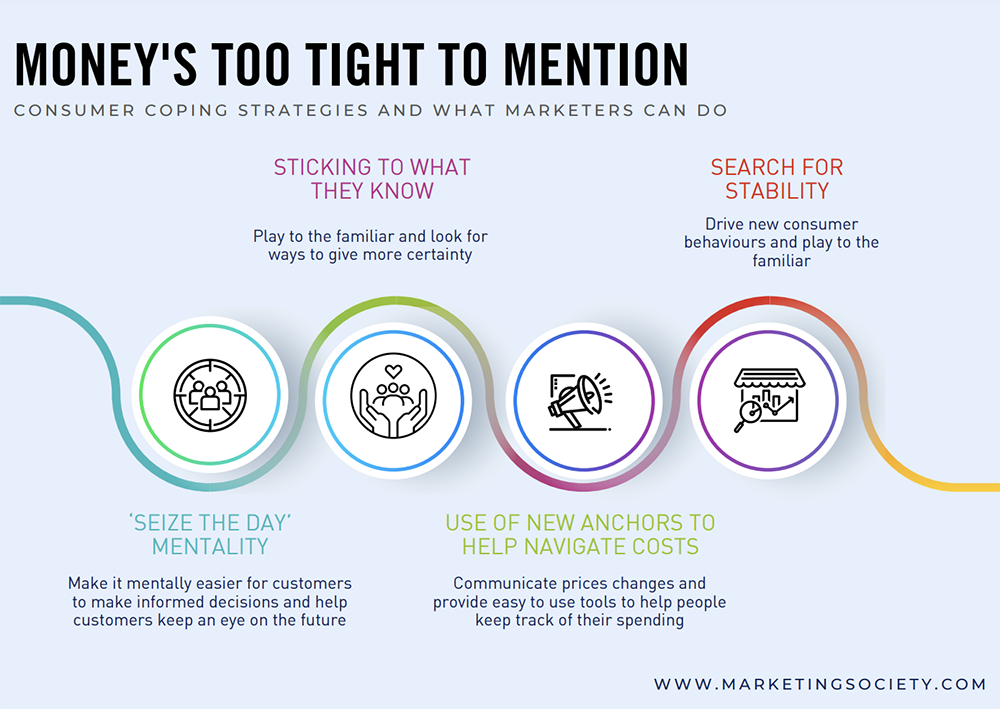

Insights from behavioural science can shine a light on how consumers may be responding to this difficult situation; from their perceptions to their judgements, decisions and behaviours. The Behavioural Architects has identified three major behavioural challenges faced by consumers:

- As consumers struggle to adjust to the new reality, they are developing complex behavioural strategies as they try to cope

- Many find inflation disorientating and struggle to navigate cost and spend. The familiar anchors and reference points have gone

- And it is a simple truth that human beings dislike uncertainty and change, clinging to certainty and stability

For each challenge, they look at how behavioural science can give us a deeper insight and then explore some of the emerging consumer coping strategies. They then summarise ideas inspired by behavioural science for how organisations can support, connect to, and empathise with permacrisis consumers.

PART ONE

As consumers struggle to adjust to the new reality, they are developing complex behavioural strategies as they try to cope

Insights from behavioural science find that people struggle to imagine events if they haven’t experienced them. Consumers born post-1992 have never lived through inflationary, high-interest rate periods and so have no reference points to rely on. Anyone born after 1992 will never have seen base rate interest rates above 10%. Ipsos UK CEO Kelly Beaver noted recently that 40% of their workforce haven’t experienced this kind of economic context before. Only those born 60+ years ago can remember the hardships of the 1970s and 1980s; Lord Stuart Rose, Asda CEO commented recently “I’m of the generation that remembers what it was like last time.” This can lead to ‘head in the sand’ paralysis or under-reaction, which is sometimes called the ostrich effect. As a result, we are seeing evidence that people’s strategies to cope are often short-termist; stop-gap actions just to get by.

We have a tendency towards optimism bias - to overestimate the chances of good events in our lives, and underestimate bad ones. People also expect things to get better quickly, or not be as bad as predicted, and may live in denial of things getting worse. They make assumptions that all will be well for their future selves. A recent Ipsos survey found 53% of people are optimistic that 2023 will be a better year than 2022. In a recent Santander survey, whilst 65% of UK retail business owners report that the rising cost of living has made running their business harder, 24% remain optimistic about the future.

Although forecasts say pressures on the cost of living will last at least a few years, many people have resisted radically changing their lifestyle to help them get through, hoping things will spring back sooner than predicted.

Consumer coping strategies:

- We are seeing an increased focus on getting through the present. Consumers have limited capacity to think about or plan for the future: urgent bills need paying, food is needed on the table today. Choosing between heating and eating is absorbing people’s precious ‘mental bandwidth’ leaving them with little ability to focus on tomorrow. To compound the problem, financial worries can reduce people’s ability to focus on other important issues in their lives, especially those with significant future implications, with the result that pensions or long term health issues are being pushed back or neglected. Many behavioural science studies reinforce this - when day to day life is stressful, it is the issues of ‘today’ that take precedence. Even trips to the dentist or optician are likely to get side-tracked

- We are seeing evidence of a ‘seize the day’ mentality. With increasingly depressing headlines, some people are prioritising experiences, holidays and living life post-pandemic, regardless of the doom-ridden economic situation. This reaction very likely stems from present bias, a brain wiring which encourages us to focus on today rather than think or plan for tomorrow. The future looks so bleak that we can’t bear to face it, so we embrace escapism. Taking travel as an example, in Q1 2023, summer holiday bookings were almost 25% ahead of pre-pandemic comparisons. Travellers have been spontaneous with their bookings too, with 45% taking place just 15 days (or less) before departure, whilst short breaks are also popular with almost a third of trips lasting for just three to four days. The reality is that this leaves many people ‘discounting the future’ - putting today before tomorrow – no longer planning for the future because it feels so difficult.

- Day-to-day, there is also evidence that people are coping by buying more little luxuries. It’s called the ‘lipstick effect’. Faced with a bleak horizon, consumers are pushing back on big ticket spending and looking for small inexpensive comforts. They treat themselves to little luxuries to give themselves a boost; anything from beauty products, to supermarket flowers, posh chocolates and coffee beans - all of these categories are booming. For relatively little cost, people can award themselves a moment of joy and a sense of escapism. Quality or a sense of luxury is paramount here - consumers must feel like they’ve bought a real treat. A recent YouGov poll found that retail therapy was the tonic of choice for 59% of respondents, who admitted to making an impulse buy to find temporary respite from glum reality.

- People seem reluctant to make disruptive changes to fortify their future, preferring instead to protect the present and make small tweaks around the edges. A survey by Deloitte for Q4 2022 showed that people are coping by buying fewer non-essentials, having the heating on less, taking advantage of discounts and offers and using a car or public transport less. But that they are reluctant to disturb the status quo with more drastic measures like looking for a better paid job or downsizing.

- This means many people are also using short term financial fixes to get by - drawing down savings and borrowing to make ends meet. By February 2023, 4 out of 5 UK adults with savings (15m people) said they were dependent on their savings to meet rising living costs. Consumers who had savings at the start of 2022 had spent 57% of those savings by July 2022 and the remainder is likely to have been wiped out in recent months, leaving people with no emergency funds at all. A recent survey found 1 in 4 UK adults have less than £100 saved and 1 in 6 have no savings at all. By November 2022 57% of people said they’d used credit cards during 2022 to make ends meet and 26% of people said they had used a credit card to pay for food. Longer term, as savings dwindle and loans are maxed out, many people could find themselves in extremely difficult situations.

Ideas and opportunities to build empathy, connection and support

Are there ways to help consumers make ends meet? For instance, Iceland offer their customers a Buy Now Pay Later option via a preloaded Food Club card which is interest free. Customers can borrow between £25 to £100 per month. Or for those with limited credit history, is it possible to build a better credit picture? Experian have been utilising rental and utility payment history and short-term loans data to build up credit scores for so called ‘thin file’ consumers. There may be many more opportunities to build novel credit scores from behavioural financial data, offering excluded consumers stability and security in difficult times.

We need to be aware that people are super tired and stressed. Stress means even small things may cause cognitive strain. Can you build extra cognitive ease into any consumer decision-making structures.

Can you appeal to the ‘seize the day’ or ‘lipstick effect’ mentality?

Be aware that if people are ‘tunnel focused’ on today they could be stockpiling bigger future issues. Can you make what might seem mundane decisions about the future easier to tackle and more appealing? Or help them keep an eye on the future.

Part two of the series is available to read here

Written by Crawford Hollingworth, Liz Barker, Lucy Pilling and Katinka Duewel- The Behavioural Architects