Saga’s recent woes show the perils of stretching a brand too far, too fast, and neglecting the core (1). The insurance and travel provider for the over-50s recently announced a £310m write-down and a 5.4% fall in underlying profits. Shares hit a new low of 33p following the news, down 80% from when the company floated in May 2014, equating to a £1.7 billion loss in value.

The share price drop reflects a brand and business in decline:

- Customers: down from 2.7 million to 2.1 million

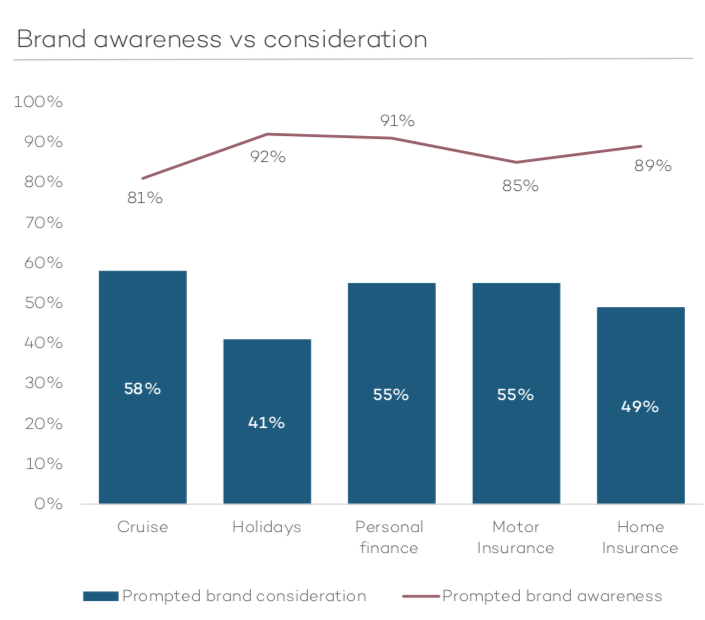

- Prompted brand awareness: down from 96% to 87%

- Saga magazine readership: down from 1.2 million to 500,000.

- Average products sold per customer: down from 2.7 to 1.4 (partly down to changed definitions)

- So what can we learn from this sorry Saga, and how might the company get back to growth?

1. Brand ego tripping

It seems that Saga was guilty of ‘brand ego tripping’: over-estimating the ability of its brand to stretch into new markets. At the time of the 2014 flotation, the company “painted an optimistic picture of Saga as a brand so potent and loved that it could be stretched to sell anything to its discerning but well-off over-50s demographic,” according to Patrick Hosking, Financial Editor of The Times (1). Saga had a growing database of ten million potential customers which, on paper, gave it “unique insights into the tastes and motivations of its target market”.

In reality, the brand stretching strategy “turned out to be a fairytale,” according to Hosking. “The core insurance business accounted for 80% of profit then and it still does now. The cruises business has made modest progress, but that’s about it.” A series of other brand stretch initiatives failed, or had limited success:

- Care homes business: sold at a loss in 2015, fours years after being bought, and later went bust

- Retirement villages: announced back in 2015 (2), but still under development

- Care at home: “largely dropped”

- Wealth management: limited growth

- Car repair workshops and Saga radio station: idea that were never launched

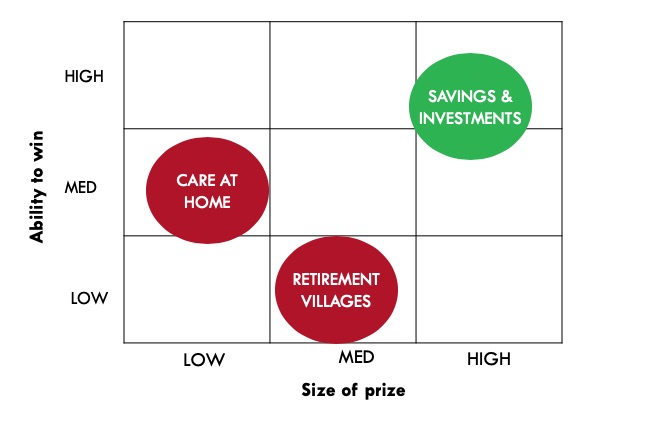

2. Ability to win

To successfully stretch you need a good concept to deliver the right “Size of Prize”. And on this dimension, it’s possible that potential customers reacted positively to concepts such as Saga Retirement Villages. After all, Saga is a well-known and trusted brand.

However, the second dimension that is often under-estimated is a company’s “Ability to win” in the new categories, and this is where Saga may have struggled. “Stretching a brand to unrelated areas is desperately difficult and managing such diverse businesses is hard, extracting synergies from them, impossible,” as Hosking rightly points out.

In Saga’s case, the stretch from insurance to financial services could leverage some competences and brand attributes (green below). The leap into care homes and retirement villages is less obvious (red below), and also conjures up more negative images of old age than, say, the travel business.

3. Neglecting the core

The issue with Saga’s stretching far from the core is not only the failure or limited success of the new services.The diversion of time, talent and funds from their core business has hit the company hard. The number of insurance policies has dropped 10% from 2.1 mill to 1.9 mill over the last four years, despite the over 50 demographic growing.

Saga’s core product has fallen short on two fronts:

Lacking a simple product optimised for “aggregator” websites, such as Comparethemarket.com

Missing a distinctive proposition to drive direct sales, which have dropped as a share of new business in both home (80% to 74%) and motor (57% to 40%) (3).

Lack of consistent messaging and investment on the core also mean that although the brand has high prompted awareness (80%+), it lacks the top of mind awareness needed to drive “mental availability” and consideration at the moment of purchase. As the company itself reports, “We need to become more top of mind to be actively considered by more of our target market (3).

4. Distinctive product offer

Encouragingly for Saga’s long-suffering shareholders, the company has recognised the issues with its core insurance business and developed a plan to get it growing again:

Broad targeting: Saga has rightly decided to drive reach, “with a broader media focus including a mix of broadcast media, press, direct marketing and digital”. Using an mix of broadcast and digital to drive reach is critical to drive penetration, especially with 50-plus consumers who remain big consumers of TV. A Facebook only campaign reaches only c. 5% of 50+ consumers, as we posted on here.

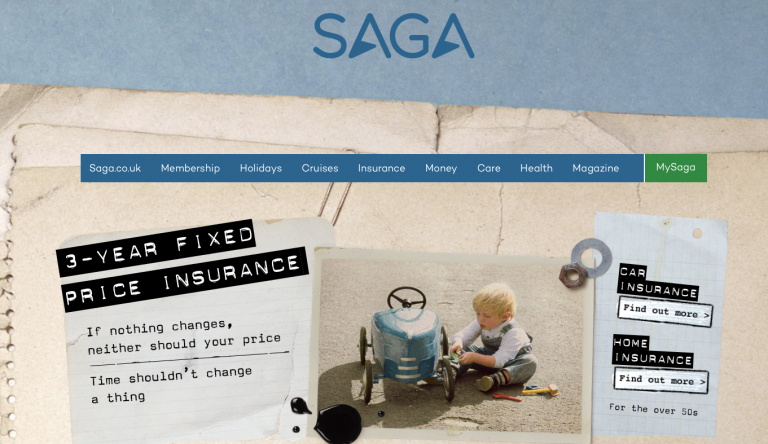

Distinctiveness to drive direct sales: the boldest move is a new three-year fixed-price insurance offer for direct consumers. This breaks the classic insurance model of tempting new customers with price promotions, and bumping up renewal prices. Saga will need to drive significant numbers of new customers to make this payback.

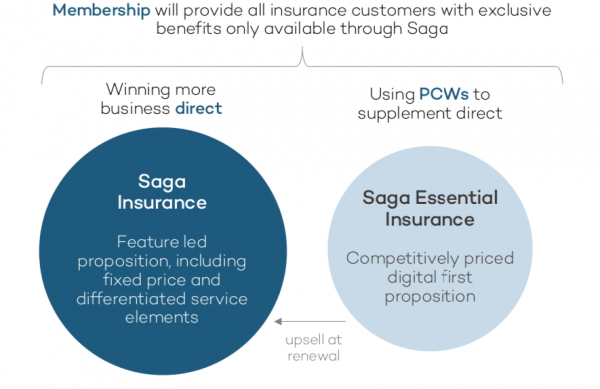

- Product portfolio: in addition to the fixed price direct offer, a competitively priced Saga Essential offer will be offered via price comparison websites, with the objective of then “trading up” customers to the premium priced Saga Insurance product.

- Membership program: Saga has signed up 1 million members to its Possibilities program in just 18 months, equating to half its customer base. The program offers “exclusive benefits, discounts on events, VIP experiences and great products from selected partners.” (3) Done well, a membership program can help drive brand and business growth, with Nike Plus members spending 3x the amount of people shopping on Nike.com, for example (4).

5. To do: distinctive communication campaign

One area where I suggest Saga is missing a trick is communication. The brand has divided its budget between two completely separate campaigns for travel and insurance. As a result, it is failing to create distinctive brand properties to build memory structure and be more top of mind. In both cases, the campaigns feel like ‘sponsored entertainment’: telling amusing stories about the category, but not telling an emotionally compelling story about the product offer:

- Travel (early 2019): using the idea ‘The World is Waiting to Meet You’, the campaign shows the mark Saga customers leave behind on the places and people they meet, featuring Mongolian local people reminiscing about Saga customers they met, for example. We never see a Saga customer, nor anything about the Saga products and service.

- Insurance (May 2019): uses a whole separate idea, ‘Time Shouldn’t Change a Thing’, featuring conversations about Saga customers pursuing their long-held passions, such as a daughter talking about how her dad has always loved dancing. Again, we never see the Saga customer. And the distinctive 3 year fixed insurance product, on which Saga is banking for growth, only gets featured 23 seconds into the 30 second ad, and even then only in the voice over.

Insurance competitor Direct Line provides inspiration on how to build a unified, brand campaign to create ‘fresh consistency’ across different chapters of marketing, as we posted on here. On contrast to Saga, the IPA Effectiveness Award winning campaign uses a series of brand properties to tell entertaining and memorable stories about its range of insurance products, rooted in the customer. These properties include the Harvey Keitel character ‘Winston Wolf’, the little red phone/mouse and the tagline, ‘Can your insurance do that?’

In conclusion, Saga is a sorry story of how stretching too far can hurt the core business and cost a company dearly. Time will tell if Saga’s new CEO can lead the team to re-focus on and revitalise the core business. The product and membership offers look promising. But a new approach to distinctive brand communication is needed in my book.

(2) https://www.ft.com/content/6cdf8eda-d148-11e3-81e0-00144feabdc0

(3) https://www.corporate.saga.co.uk/media/1268/saga-plc-2019-prelim-results-final.pdf

(4) https://s1.q4cdn.com/806093406/files/images/irday/Heidi-Adam-Transcript-with-slides.pdf

This piece first appeared on the brandgym's website here