High street banking group RBS’s closure of its new digital bank Bó shows the risks of launching new brands to compete with smaller ‘insurgent’ brands. In this case, RBS was trying to keep up with fintech ‘challenger banks’ like Starling and Monzo. The idea of Bó was to be a ‘second’ account with a debit card to help you ‘spend less and save more’.

RBS invested an eye-watering £100million in the launch of Bó but it lasted only five months before new CEO Alison Rose pulled the plug. What can we learn from what looks like a costly cock-up?

1. All ‘sizzle’, no ‘sausage’

Bó had all the outer image trappings of a digital challenger brand, what we call the emotional ‘sizzle’:

- Millennial target audience: tick

- Short, snappy name including a little accent on the ó: tick

- Bright colours: tick

- Informal, chatty tone of voice: tick

- Cool looking card: tick

But what about the product ‘sausage’? How did Bó’s service offer stack up versus Starling and Monzo? Here, the new brand was lacking. “In terms of the features, there doesn’t seem to be anything Bó offers that its competitors don’t already do,” reported Which. In fact, it looks like the fundamental proposition lacked relevance. Whilst Bó tracked spending and helped you set goals, it had serious shortfalls vs. Monzo:

- Only accepted bank transfers vs. Monzo also letting you pay your salary in

- Only one saving ‘piggy bank’ account vs. Monzo multiple savings pots

- No interest vs. Monzo up to 1.4% interest

- No overdraft vs. Monzo offering overdrafts

The lack of distinctive features, combined with what one report says was a “tech stack plagued with problems”, was reflected in the Bó scoring only 3.2 out 5 on the iOS Appstore.

2. Late to ‘the innovation party’

RBS was late to ‘the innovation party’ with Bó. By the time it arrived in November 2019, a full four years after Monzo, the lights were up, the DJ was packing away his gear and people were getting their coats!

By this point Monzo had won 3 million customers and Starling 1.3million. Both of these brands had gone through countless upgrades and refinements and learnt about their customers. This enabled them to sit at 3rd (82%) and 2nd (82%) in Which’s customer satisfaction survey, way above the high street banks of Bó’s parent company: Nat West was 12th (69%) and Royal Bank of Scotland 19th (62%).

This late arrival meant that Bó needed a big bang to make any impact on the market but, as described above, the new brand failed to bring enough exciting news to the party. By the time it closed, Bó had only amassed a total of 11,000 customers, less than half the number of new customers Monzo added in Q4 of 2019.

3. Alternatives to new brands

Clearly, RBS is right to respond to the rapid and radical changes in financial services. But if a new brand like Bó was no-no, what are the alternatives?

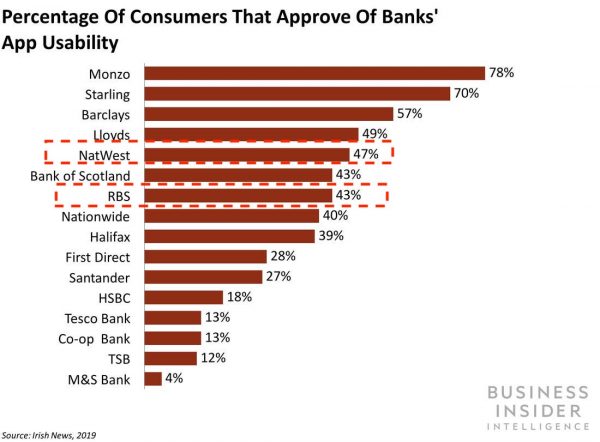

First priority, I suggest, is revitalising the core. Nat West alone has c.7.5million customers in the UK, meaning that 0.15% growth in customers would equal the whole customer base Bó acquired after five months and £100million. And Nat West and Royal Bank of Scotland have a lot of work to do in improving their core digital offer. The apps offered by the two brands have satisfaction scores less then 2/3 that of Monzo (below).

Core revitalisation should have a good chance of paying off given that consumer are in fact keen to stay with the big banks, despite their service shortcomings, according to our research.

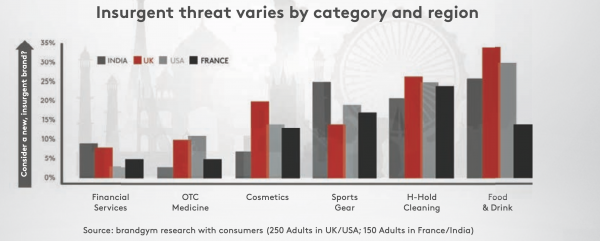

Financial services had the lowest level of interest in switching to new insurgent brands of six categories studied (below), reflecting the trust that people have in established bank brands, and concerns about financial security of new brands.

Beyond revitalising the core, another option would have been to follow the example of many big consumer goods companies and invest in our acquire a start-up brand. The culture and operating model needed to create and build a start-up are very different to that found in most big companies, which tend to better suited to ‘scaling up’ small brands once they reached a critical mass.

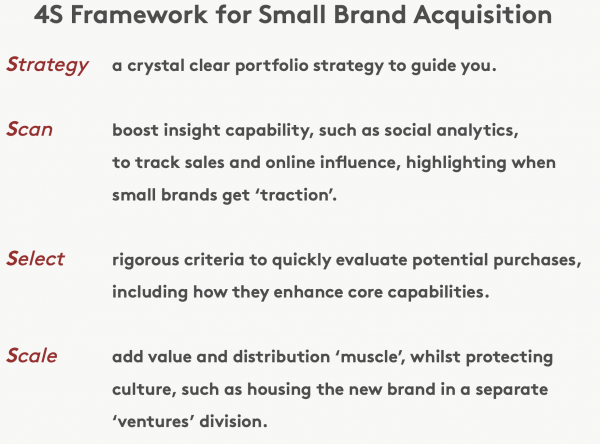

We propose an approach summarised as ‘4S’ to help big companies maximise the chances of success when seeking to invest in smaller insurgent brands:

In conclusion, the sorry tale of Bó shows the perils of trying to launch a new brand and why it should be the last resort, after all other options have been considered.

If you do choose to press the new brand button, then be sure to arrive at the innovation party early, not late, and come with a distinctive and high performing product proposition, not just the outer image trappings.

This piece first appeared on brandgym's website here.