With a wide variety of home-grown platforms, technologies and behaviours, understanding the Chinese digital landscape can be both daunting and difficult. Fortunately, We Are Social‘s new report will help to demystify things.

Continuing our series of studies into digital trends and developments around the world, our new China report profiles a variety of critical data points, including the penetration rates of different technologies, the top-ranking social platforms, and a wealth of interesting facts and figures on Chinese netizens’ behaviour.

You’ll find full details in our SlideShare report below (and more info here), but here are some of the report’s highlights:

Country Overview

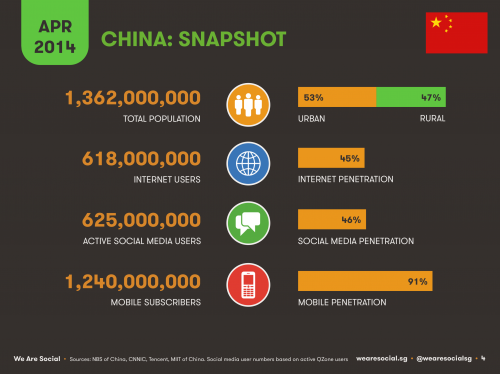

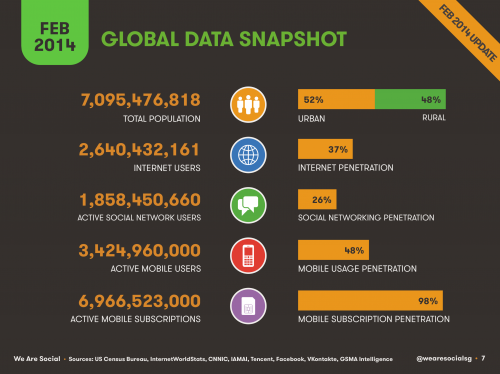

China’s population exceeds 1.36 billion people, with urban areas accounting for more than half of the country’s residents. 51% of the country’s population is male. China’s 618 million Internet users represent 45% of the country’s population, and account for almost a quarter of the world’s internet users – for reference, here are the latest global stats:

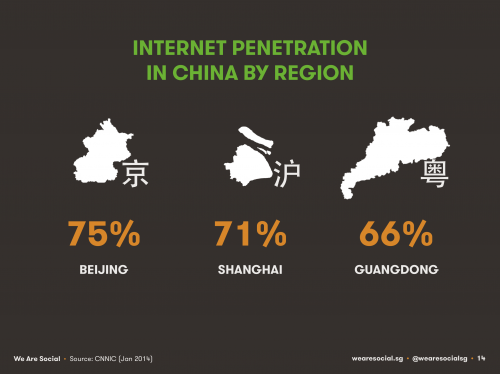

The majority of China’s internet users live in urban areas, with fewer than 1 in 3 living in rural parts of the country. Beijing (75%), Shanghai (71%) and Guangdong (66%) have the highest Internet penetration of the country’s administrative regions:

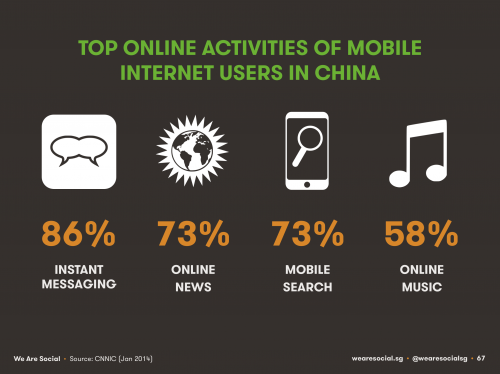

Instant messaging (IM) is the most popular online activity in China, with CNNIC quoting in excess of 530 million active users across platforms. However, Tencent’s QQ, China’s most widely used IM platform, boasts more than 800 million active accounts, suggesting many Chinese IM users may manage multiple accounts.

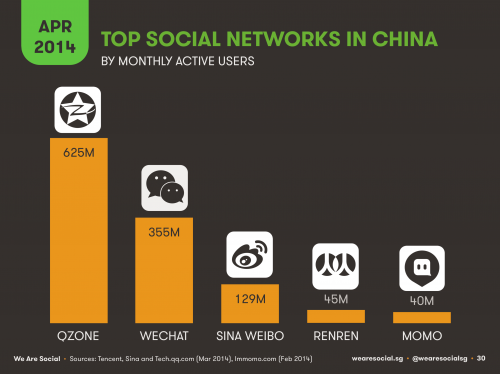

Although QZone claims to have the highest number of active social networking users at 625 million, Weixin (WeChat) and Sina Weibo are the current ‘darlings’ of Chinese social media, with 355 million and 129 million monthly active users respectively. Brands continue to be highly active on Sina Weibo, contributing to a reported 153% year-on-year growth of Sina Weibo’s advertising revenue in Q4 2013.

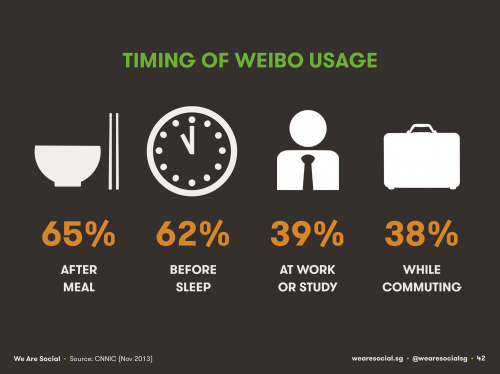

In terms of the users themselves, and reflecting a behaviour pattern we see on other social platforms across Asia, China’s micro-bloggers can’t seem to resist checking Weibo immediately after food:

Weixin (WeChat) users are actively using the platform’s various chat features like text and voice voice messaging , as well as its social networking features like ‘Moments’:

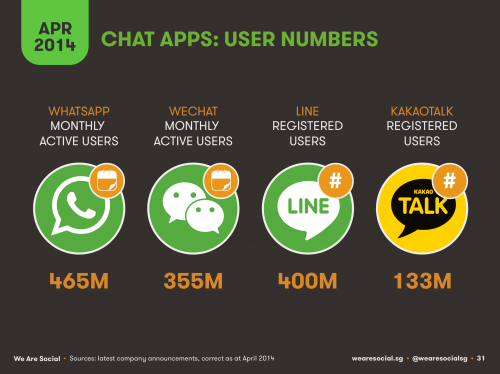

It’s worth pointing out that WeChat is now the world’s second biggest active chat app service, and is still growing at a staggering rate

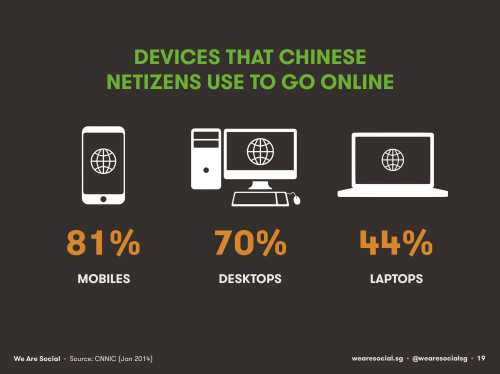

Roughly half of China’s population now owns a mobile phone, with each user maintaining an average of nearly 2 active SIM subscriptions. The ubiquity of mobile devices makes them China’s internet tools of choice, with 81% of the country’s netizens accessing the Internet via mobile handsets:

In line with this, mobile shopping and mobile payment services experienced significant growth during 2013:

Online shopping as a whole is hugely important to China’s economy, contributing almost US$300 million in 2013 alone. Group buying is particularly popular, and was the fastest growing online activity in China, with a robust growth rate of 69% in 2013.

If you need more numbers, be sure to check our full 95-page report below for loads more useful and interesting stats.

Simon Kemp is managing director at We Are Social Singapore. Read more from him @eskmion