With the launch of Metro Bank – the first new retail bank in the UK for over 100 years – Hill, the owner of prominent existing brands such as Commerce Bank, has brought his successful US model across the Atlantic.

By nailing the myths of retail banking – which include the idea that customers don’t like to switch banks, only value interest rates on their savings, that cutting costs is the only way to profit and that the high street branch is dead – Hill has produced a bank that promises a customer experience comparable with the best retailers.

This stands in stark contrast to Britain’s existing high street banks, which, to Hill at least, tend to treat their customers poorly.

Metro Bank’s business model is clear: the bank is deposit rather than loan based, with branches (four already opened in London, with another 200 planned) dedicated to providing excellent service.

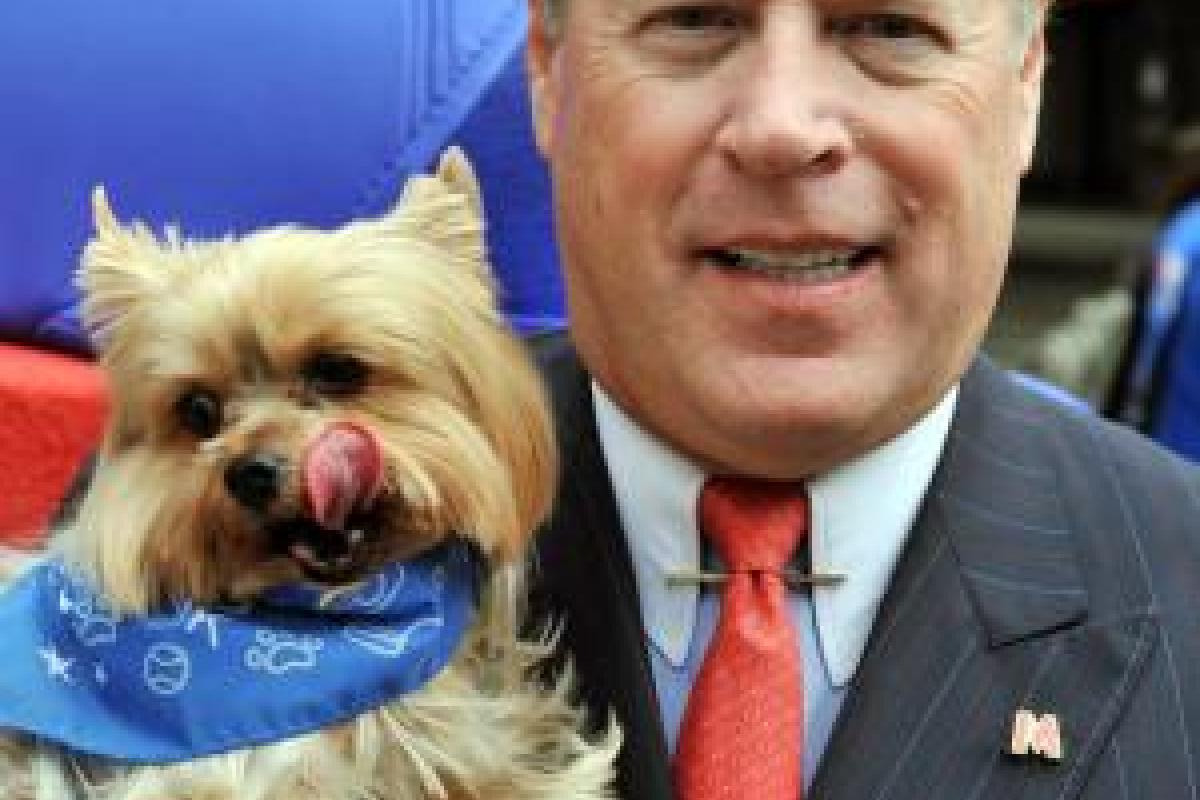

To achieve this goal, the firm has differentiated itself from its rivals: opening hours are 8am to 8pm seven days a week, pens are handed out freely rather than attached to counters, and dogs are welcomed rather than banned. Significantly, staff are hired for attitude and trained for skills rather than the other way round.

Some of these differences seem minor – but taken as a whole they are symbolic of a more enjoyable, less annoying branch experience.

Judie Lannon, editor of The Marketing Society’s quarterly journal, Market Leader, was reporting on the Annual Conference for Warc.