People are anxious around money, we want to change that

"People are anxious around money, we want to change that"

Targeting 18-35 year olds who increasingly want to consume and self-serve through the phone, Atom Bank are Europe's first exclusively mobile bank. Launched in April 2016, Atom can already count an active user base of 14,000, and have Spanish giant BBVA, as a cornerstone investor with a 29.5% stake - a figure which implies Atom already have a valuation of £150 million (US$226.6 million). At the helm is Anthony Thomson, former founder and chairman of Metrobank, who first splashed some colour onto the high street in 2010 as the original challenger to the British banks. Adam Morgan talks to Anthony to find out if ruffling the banking establishment feathers is a repeatable act and if so, how this time around?

Let's start by you telling us a little bit about your personal journey of being a challenger in the financial services world?

I started out in marketing 30 years ago and unlike clever marketers, I have a pretty simple view of marketing, which is it’s about looking at data to find an insight that drives an opportunity.

In 2007 I saw that Commerce Bank was having huge success in America by focusing on delivering great service and experience, and I brought that same model to the UK as Metro Bank in 2010. It was the first new high street bank in the UK to launch in over 150 years and today it has 48 stores nationwide.

In 2012 I then witnessed the largest change in consumer behaviour I had seen in 30 years of looking at banking data. I saw that consumers were moving from traditional branch-based banking to digital in general and mobile in particular and that insight drove me to launch Atom Bank, Europe's first exclusively mobile bank.

“The test of a genuine challenger is whether they have a disproportionate impact on the industry.”

What sets Atom Bank apart from the other new entrants the government and much of the media now label ‘challenger banks’?

There are many new entrants in finance, often described by the phrase 'challengers', but many of these new banks are really just doing the same things as the incumbents. To be a challenger you have to offer something very different from the status quo and that’s what we’ve set out to do.

The test of a genuine challenger is whether they have a disproportionate impact on the industry. Metrobank was a good example of that, from day one, we rewarded staff on customer satisfaction, rather than on sales, and measured that scrupulously. Within two years all the high street banks followed us in moving away from rewarding sales.

We’ve seen brands like TransferWise, and how they have changed how people get foreign exchange. It was a very expensive consumer product but they found ways to remove the vast majority of those costs and created a much better customer experience.

So what is Atom Bank challenging?

Money is changing. Today it is digital. I’d be very surprised if you see much of your actual money. So money has moved from being physical to just being data, and I could make a compelling case that Atom is a data business that just happens to have a banking license.

We help people change their relationship with money by using that data to help people manage their money more efficiently. It's about redefining the information that people need to make decisions on their finances and making the experience as frictionless as possible. Customers want to do it when, where and how suits them.

The world is changing at an incredible pace. The way we’ve architectured Atom is to do all of the traditional things as well or better than the existing players, but also to ensure we have a future-proof platform to deliver what customers want in years to come.

What is wrong with people’s relationship with their money, and why do you want to change that?

The reality is that nobody likes banking. People are anxious around money. The vast majority of millennials especially are worried that their money won’t last until the end of the month. People are terrified about opening bank statements; they’re terrified about checking their balances.

So whilst high street banks may give a statement at the end of the month which tells customers how they have already spent their money, we give customers a prediction on next month’s bank statement and the month after and the month after.

Now, clearly they are not going to be precise, but the more we get to know our users and understand the data, the better we can be at predicting and the better the relationship people will have with their money.

What’s your marketing strategy for building brand awareness at the right speed?

Social media is clearly at the heart of activities, but if you want to create awareness and fame quickly, traditional media still has a place to play. We had a pre-registered customer base of 28,000 people and they largely heard of us through press articles and media coverage.

To highlight the anxiety people have around money we created an exercise where we flipped that on its head and said let’s make that relationship a very pleasant experience. We hired the Royal Philharmonic Orchestra to help create ‘The World’s Most Relaxing ATM’, showing that using an ATM doesn’t have to just be functional.

The story was reported in The Mirror and The Metro newspapers and gave us considerable awareness just a few months into our launch. In terms of the money we’ve spent to date, I’d be astonished if we’ve spent more than a few tens of thousands of pounds.

So if you’re looking to set up an entirely new kind of bank, who have you learnt from, if not financial services?

We have a Chief Innovation Officer, Edward Twiddy, whose job it is to scan the horizon of categories and geographies outside of our own to see what we can learn. One of the first things we did was to look at who gives consumers the best screen experience, and generally we found that to be within gaming.

“We’re happy to steal ideas from anywhere that we can.”

So we thought how do you create a similar kind of gaming experience at the screen for banking? We did this by building the app using the same 3D language many game developers use (and in our case it’s a language called Unity), which enables us to build incredible three-dimensional models at the screen.

We’re happy to steal ideas from anywhere that we can. I think originality was once described as simply concealing the source.

Tell us what are the two or three signature aspects of the customer’s experience of Atom Bank?

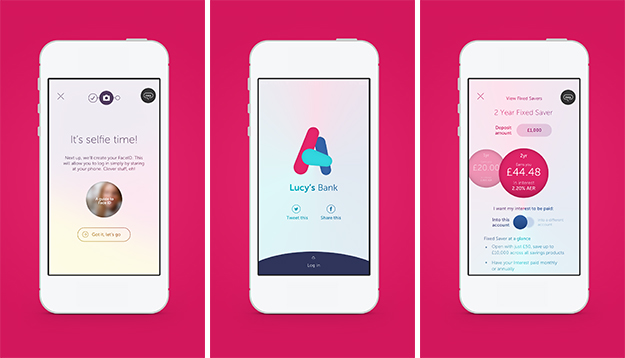

The first thing is about making it your bank, not our bank. When you register for your account the logo won’t display Atom bank, but Adam’s Bank or Mark’s Bank etc., and users get their own unique logo. We actually have 1.5 million unique Atom logos, which vary quite considerably in colourways and form.

Another aspect is that we use a biometric gateway. By far the simplest way for people to access their account is to just look at the screen, so instead of having to put in a password you just take a selfie with your phone's camera.

It’s about introducing anthropomorphic and human qualities through the technology. Not at the expense of efficiency or functionality, but where it's appropriate we want to make the experience as playful and enjoyable as possible.

What would success look like for Atom Bank?

The long-term value lies in the customer relationship that we build over time and that comes through the current account.

But at risk of sounding like a boring banker - and I’ve spent ten years claiming I’m not a banker, I’ll have to give up and admit I am, at some stage, current accounts per se are not profitable. It is the fact that through that relationship customers tend to buy other products, which makes current accounts profitable.

I would measure our success in terms of customer satisfaction because, for me, everything else follows on from that. I believe if we give customers a better product, service or experience, we will be profitable. Profit is really a by-product and sadly banks have forgotten this, they think they just exist to make money.

What would be your three bits of advice to someone who is thinking of fundamentally changing a category?

The first thing is to always have the customer’s interests first. Is what you’re doing going to give a better product or service or experience to a customer? If it isn’t, why are you doing it?

The second thing is to have a very clear idea as to what problem you are trying to solve and ensure all the people around you are aligned to and understand that. I see lots of businesses today that have wonderful solutions for which there isn't really a problem to solve.

The third is about believing in what it is you’re doing. I sit down with all of the people who join Atom, and ask whether they believe in what we’re doing. If they don’t, they shouldn’t be here. We don't want people here just because it’s a job. Life’s too short to do things you don’t believe in.

This piece first appeared here.