Unlocking the power of the old-fashioned post

With the UK's Royal Mail now making profits for the first time in many years and about to be privatised, it's a great time to think about what it is about a letter that excites us. ‘Snail mail’ - whether in the form of a personal or business letter - is still widely considered to be more powerful than digital communications and well worth the investment.

There's the tactile interaction it demands; we hold it in our hands, we rip open the seal, we unfold the letter to read it; and then there's the aura of lottery about it – very important information is usually sent by post – so there is always a jackpot anticipation as we wonder if something really significant has arrived. And then there's the increasingly rare splash of real ink and some actual handwriting to intrigue us. Maybe it’s the unexpectedness or variety of mail that lands on our doorstep every day. Who hasn't sifted through the obvious bills on the doormat to pick out the mail that's not immediately identifiable, or that which is undoubtedly a personal letter?

There's also the fact that somehow it feels more secure to have hard copies of important documents delivered through the post, with the postman's recorded delivery adding that little extra finesse. On top of this the rapid growth of online shopping has also given a halo effect to this delivery channel. Whatever our approach to snail mail, it's clear it is a medium that is rich in behavioural psychology and one that offers a great opportunity for clever behavioural nudges.

The power is clearly reflected in comparisons between the response rates of hard copy direct mail versus email campaigns. Response rates to letters are typically 30 times better then email – around 3.4% for direct mail, compared to 0.12% for email in 2012. Although the costs of direct mail are much higher than emails, the good old letter remains a popular marketing tool and still accounts for over a third of direct marketing expenditure in most countries.[1]

In this article we:

- First, try to dissect the power of the letter through a behavioural science / behavioural economics lens; and

- Second, we examine how we can use some of the new insights from the behavioural sciences and psychology to write letters which are more likely to gain the desired response.

The draw of the letter

A letter's key draw is likely to be greater salience and higher attention rates compared to email. As behavioural scientists Paul Dolan and Robert Metcalfe comment, “Letters are attention-grabbing; emails are not.”[2] We can check our emails everywhere and anywhere and, as a result they often don't get our full attention. By contrast letters are received and read at home or at our desks where we may be less distracted. And, practically anyway, they require more of our attention - we have to pick them up to open them - so we're more conscious of them as we deal with them.

Further, we open letters one by one, focusing our attention on each letter consecutively. Email can be harder to focus on, especially since email providers have devised default alerts for new email. So we might be halfway through reading one, when another arrives in our inbox, distracting our attention from the email we've started to read. As we all know, email has the tendency to get lost in the inbox once it has been shunted down the page where its status becomes increasingly out of date and irrelevant.

Further, email is often disadvantaged by the presence of hyperlinks which have been shown to distract us. Nicholas Carr, author of ‘The Shallows: What the Internet is doing to our brains’ has highlighted several pieces of research which show that we can become overwhelmed when reading something online if there are too many hyperlinks embedded in it. We become distracted and tired from needing to make continual choices about whether to click on a link. Research has also found that we absorb less information when reading something which is heavily hyperlinked; we tend to miss the primary message and are less likely to think deeply about what is written.[3] So a well-written letter will have a significant advantage in this respect.

A letter also has the advantage of an envelope which can hide the sender’s identity and pique our curiosity enough to get us to open it. Email can never be anonymous and we have developed mental short-cuts or heuristics to sift out junk mail from our inbox simply by scanning the name of the sender. The very alert among us might also have developed other short-cuts which allow us to recognise the specific days and times of the week when companies send email flyers which we know are of no interest.

Lastly, depending on the nature of the letter and the degree of personalisation, letters can evoke a greater feeling of commitment in us. We acknowledge the time and effort someone has put in to writing to us, to stamping and posting the letter and this can make us feel more committed to responding. Dolan and Metcalfe recently published findings comparing online versus offline communications. When First Utility sought to encourage UK customers to reduce their energy consumption by giving them information about the energy consumption of their neighbours, it was communication of this by letter rather than email that produced the desired behaviour change. [4]

Writing successful slow mail

Insights from the behavioural sciences have helped to illustrate why letters may have some clear advantages over emails and digital messaging in generating a response. But behavioural economics can go further and offer insights on how to write a better, more attention-grabbing letter. For example, behavioural economics can help us to understand what affects response rates and to identify potential triggers and barriers to responding. Does the envelope prompt the receiver to open it immediately? Does the letter itself generate enough urgency or emotional response to galvanise the receiver into immediate action? Tackling these barriers and making more use of known triggers could help us to design better letters in the future. It helps to break down a customer response into two stages of behaviour:

- Does it grab our attention?

- Does it nudge an action or response?

1. Attention grabbing

The envelope – its design, colour, franking and labels – is clearly a key part of getting our attention. With limited time in our lives and often little interest in direct mail and dull bills, we have developed heuristics or rules of thumb to spot the more personal, interesting items of mail and filter out the bills, statements and offers (just as we do for email as discussed above). So mail in the latter group might go straight into the bin or sit unopened for weeks until we can face opening it.

One study analysed direct mail campaigns in Germany to gather empirical information about what might prompt someone to open a direct mail letter. They looked at 677 direct mail campaigns from non-profit organisations and financial service providers and classified their different features such as design of the envelope and method of postage. For both industries, a coloured envelope had a negative effect on the opening rate as did a franking stamp e.g. ‘postage paid’. People used both colour and the type of stamp as an heuristic; coloured envelopes and franking stamps being a mental shortcut for ‘mass impersonalised commercial mail’ for most people (so these types of direct mail campaigns are most likely to end up in the bin). By contrast, blank, white envelopes with an individual (actual) stamp offer a mental short-cut for personal communications likely to be of interest, and so these types of campaign are more likely to be opened. It's certainly not rocket science.

For the financial service providers in the study, including their logo or a teaser on the envelope also reduced opening rates. Logos on the front of an envelope give us too much of a clue as to what they might contain, to the extent that some companies – particularly those who perhaps have a less appealing brand or product - now prefer using a plain white envelope. It's all about not giving the game away and hanging onto some of that jackpot anticipation we mentioned earlier.

2. Keeping and nudging action

Of course, opening a letter is only the first step to responding. Once opened, behavioural sciences can help keep us focused and en route to a prompt response. Concepts from the behavioural sciences, such as reciprocity, System 1, social norms and affect bias show how our responses to a letter can be affected. For example, Daniel Kahneman highlights the importance of maximising fluency i.e. how easy the text is to process. Fluency or ‘cognitive ease’ can be increased by making the key message stand out and ensuring it requires minimal effort to process, relying more on System 1 than System 2.[5]

For example:

-

Using simple rather than complex language where possible – psychologist Daniel Oppenheimer found that we actually perceive people to be more intelligent when they express their ideas in straightforward language, using basic vocabulary.

- Simple font styles, such as Times New Roman are also important for easy comprehension. Flowery, italicised fonts are thought to be more difficult to process.[6]

- Using bold text to draw attention to key information – this can help us both to assimilate the key messages and gain our attention, as well as organise the information into its relevant parts. Notably, font size is thought to have little effect on assimilation.[7]

- Using red and blue text for the same reason – these colours stand out well on the standard white background.

Let's look more closely at more concepts in action in a range of letters to consumers and how they have been working in Germany, the US and South Africa, as well as in the UK:

The German study already mentioned also looked at what might induce consumers to retain a direct mail letter with a view to responding to it. They found that encouraging them to take small steps, such as requesting further information as an initial response was effective. People can be anxious about the idea of committing to signing a contract or purchasing a financial product in one go - it's too big a step to take, so they are very likely to procrastinate or fail to act at all. Breaking response options down into smaller steps and chunking the stages to completion has been shown to be an effective way of generating action.[8]

Another study, this time conducted in the US, highlighted the power of personalisation and reciprocity in increasing response rates. Researchers studied response rates to a 5-page survey on which post-it notes carrying handwritten messages politely requesting completion of the survey were stuck onto page one of the questionnaire. There were three cells in the study: those who received a survey questionnaire and cover page only, those who received a cover page with a handwritten message on it and a questionnaire, and those who received a cover page and a questionnaire with a handwritten, yellow post-it note stuck to it (yellow has been shown to be the most effective colour in gaining our attention).[9] Both the post-it note and handwritten message said “Please take a few minutes to complete this for us. Thank you!”.

The results were quite incredible: response rates were 36%, 48% and 76% respectively. People were far more likely to respond to the hand-written post-it note. Researchers believed this was due to a feeling of social obligation derived from the recipient recognising that the required response must be important if the sender had spent their time and effort writing to them personally, commenting: “The norms of reciprocity and social helping are ingrained in our culture.” If the experimenter added his initials and the responder’s name to the post-it note the response rate climbed still further. And when responders were sent a longer survey (150 questions across 24 pages as opposed to just 5 pages) once again the post-it note led to the highest response rates among responders. It is perhaps not surprising that we are more likely to respond when we are directly and personally sought out, prompted either by our egocentric bias - ‘Of course they want my input’ - or our sense of social responsibility (what's often called an injunctive social norm by behavioural economists) or even reciprocity bias - ‘This person has gone to such an effort to contact me, I really must reply’.[10]

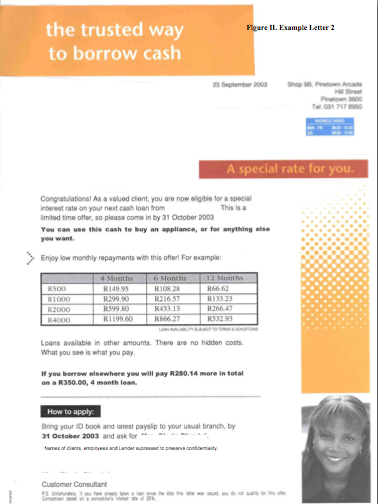

Another field experiment, this time in South Africa, discovered that a photograph of an attractive employee was a good way of drawing attention to a letter. Behavioural economists teamed up with a finance lender to run a randomised controlled trial offering loans to 53,000 of its customers. They tested eight variables, many of which applied different concepts from behavioural economics. These included:

- Adding a photo of an attractive, smiling employee to the letter (male customers were sent letters with a photo of an attractive female employee, female customers an attractive male employee): behavioural economists would say an image acts on our gut feelings or our ‘System 1’ responses. Firstly, it attracts our attention because it is conspicuous - it stands out over text, and secondly, an attractive image elicits a positive emotional response. This is also known as affect bias - when our behaviour is led by our emotional response to stimuli.

- Showing examples of four different loans: the mid-section of each letter included a table showing different numbers of example loans, from just a single loan, up to four examples of loans. The researchers speculated that overloading people with many different choices can lead to procrastination and inaction. More choice is not necessarily a good thing since we can easily become paralysed by indecision as we struggle to compare the options. So including just one example of a loan might actually make a decision easier.

- Suggestions for a use of the loan: the researchers hypothesised that outlining a particular use may lead to more rational deliberation – engaging our ‘System 2’ thinking - and ultimately more procrastination than action as consumers considered if they required the loan for that use or another.

- Information about the interest rate: once again researchers hypothesised that this may lead to more reasoned, rational deliberation – engaging our ‘System 2’ thinking - rather than immediate action based on emotional, intuitive response.

- Comparison frames: such as “If you borrow elsewhere, you will pay R100 Rand more each month on a four month loan” - these drew on the behavioural economic concepts of framing (when we present information in alternative ways), here framing a competitor loan as a potential loss to deter customers from looking elsewhere for a loan, and loss aversion (we feel the pain of a loss more than the buzz of an equivalent gain).

(An example of the letter is shown at the end of this article.)

They found some surprising results. Three of the interventions made a noticeable impact on take-up rates for the loan:

- including a photograph of an attractive female employee,

- showing only one example loan

- not outlining a specific use for the loan in the letter

Each of these interventions increased take-up rates to the same degree as a 25% reduction in the interest rate. Interestingly, however, these effects occurred only amongst male customers. Female customers did not respond to any of these content changes (and frustratingly the report offers no explanation for the difference in response).[11] Behavioural economics can help to suggest why these interventions worked; for men at least salient and attractive photos grab attention quickly and immediately elicit a positive emotional response, and providing just one example of a loan and not linking it to any particular use makes it easy for customers to process, and reduces deliberation.

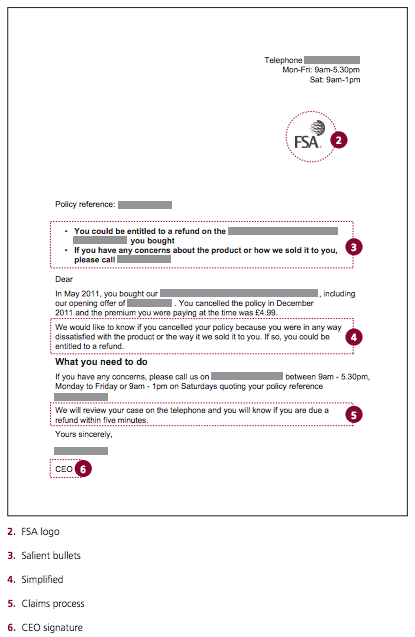

There has been other evidence which supports the need to spell out key messages by highlighting significant information in letters. The new Financial Conduct Authority (FCA) has run a successful trial looking at how to improve communication to consumers who are being offered redress for mis-sold products. Companies often write to their customers notifying them that they might be eligible for compensation, but usually achieve a poor response rate. The FCA looked into this problem by working with a firm that was voluntarily writing to almost 200,000 customers about a past failing in its sales process. Using insights from the behavioural sciences, they designed several different versions of a letter (see image below) with the aim of increasing customer response rates. They tested for the effects of design and content features such as the FCA logo, letter signatory, simplification of the letter text or putting the key information as impactful bullet points at the top of the letter. For example, bullet points appeared at the top of the letter, in bold text, saying: “You could be entitled to a refund on the XX product you bought. If you have any concerns about the product or how we sold it to you, please call xxx.”

The inclusion of bullet-pointed information had the greatest impact, raising response rates by 3.8% over the control, whilst combining all of the positive interventions together into one letter led to response rates seven times better than the control.[12] These are interventions that cost virtually nothing to implement – in both money and time - but reap a very rewarding response.

In the US another trial focused on highlighting key information in letters from doctors to patients and has had remarkable success in raising response rates. The behavioural economics research consortium ideas42 partnered with the Medicaid Leadership Institute and a team from Oklahoma Healthcare Authority, SoonerCare, to implement a randomised controlled trial for diabetes patients. Letters were sent to 2,500 patients diagnosed with type 2 diabetes who had not yet begun statin medication, despite their condition. The majority of patients received one of the following interventions:

- One group received the basic letter encouraging them to call their doctor to arrange a cholesterol check and discuss a statins prescription; this was the ‘rational’ letter if you like, providing only the information patients should require if they reacted in a logical way.

- A second group received a $5 gift card with their letter which could be activated after attending an appointment. Research has shown that people respond well to ‘carrots’ and short term financial incentives, especially when faced with a large task where the end goal seems distant. Behavioural economics has defined the concept of time inconsistency, or the ‘power of now’ where we value gains today more than tomorrow. Therefore, incentivising patients with a reward today can help to engage them in acting for tomorrow.

- A third group received a letter which had been redesigned to include a suite of ‘behavioural nudges’ such as making the consequences of remaining untreated more front of mind, or including hand-written post-it note reminders. These utilise behavioural economics in different ways. We dislike losses – so making the possibility of undermining our health by our own inaction more obvious to us can prompt us to do something about it. We can also find it difficult to imagine our future self-suffering from illness, so communicating information in a vivid and emotional way can make us more inclined to act. There may also be a component of the ostrich effect – when we try to ignore the new information around us and continue as normal. Highlighting the consequences of remaining untreated can make it harder to ignore new information. Post-it notes, as discussed above, can leverage the concept of reciprocity and also make it clear that if a doctor has taken the time to write personally to a patient, it must be important.

The results were promising and clear cut. Those in the third group who had received the behavioural nudge letter saw a 78% increase in response and uptake of statins compared to the control group. Providing an incentive or a ‘nudge letter’ together with an incentive also had a marked effect on response but less than the ‘nudge letter’ alone. The team are now looking into how to develop this initiative further.[13]

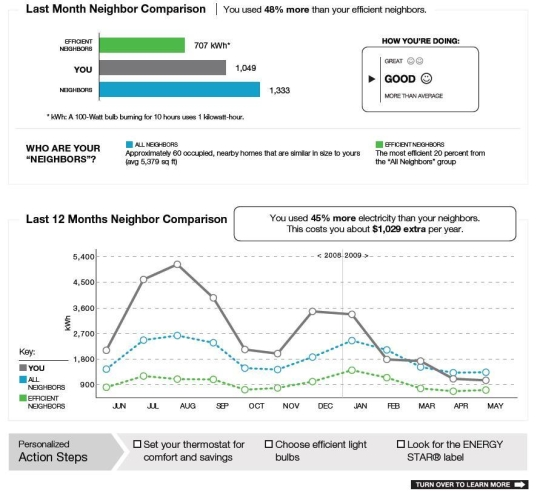

The US energy software company Opower have developed clever ways to write to households about their energy bills. They work with utility companies all over the US, Australia, New Zealand, Canada, France and the UK to send out specially designed letters to customers in the form of Home Energy Reports which use descriptive social norms (things that everyone else is doing) to tell people how much energy their neighbours are using. They include statements like “You are ranked #28 out of neighbors like you.", or "You used 32% more energy than your efficient neighbors". (See image below.) These interventions revealed that when above-average consumption households realise how much energy they are using in relation to their more conservative neighbours, their energy consumption goes down. The Reports also make use of injunctive social norms (things we know we should really be doing). Below average users are rewarded with smiley faces on their bills to limit what researchers call ‘the boomerang effect’ which is when the energy consumption of below average users actually increases as they learn that their neighbours are using more energy than they are, prompted by the very human reaction ‘Well, if no-one else is trying to save energy then why should I try so hard?’

Results for Home Energy Reports are promising. Figures from 14 different randomised trials for 600,000 households across the US show that the average program reduces energy consumption by 2% - which, although small, begins to add up at a national level. In real terms that's comparable to turning off an air conditioner for 37 minutes a day or a light for 2 hours a day. For the heaviest energy users, the energy reports actually reduced consumption by as much as 6.3%, while existing low energy consumers sustained low consumption levels.[14]

In the UK, recently published results have demonstrated a much higher response rate to similar Home Energy Reports. Paul Dolan and Robert Metcalfe ran a randomised controlled trial on 569 households on a housing estate in Camden and found that social norms information similar to that described above, reduced energy consumption instantly, by as much as 11% on average, and over the longer term across a period of 16 months, reduced consumption by 7%.[15]

Finally, the UK government has already been putting social norms to good use in tax letters sent out across the country. A trial run in 2011 by the Behavioural Insights Team and HMRC to encourage tax debtors to pay up used a social norm statement to increase response rates. Tested on 140,000 people, the social norm letters, which contained the information that '9 out of 10 people had already paid their tax..', outperformed the (non-social norm) control group letters significantly. The greatest impact came from the statement which informed debtors how people in their immediate locality had paid their tax: ‘9 out of 10 people in your town pay their tax on time’. This statement led to an 83% response rate, compared to the 67.5% response rate of the control group. The Behavioural Insights Team estimate that this could generate £30 million of extra revenue per year for the Exchequer, as well as advancing over £160 million of cash flow by approximately six weeks each year.[16] This may be pocket money for the government but if it means fewer cuts in other areas of government and more savings found through other similar interventions in other departments, its significance grows.

Conclusion - It’s in the mail!

Words which describe the arrival and impact of letters include surprise, tactile, personal, attention grabbing, physical presence, anticipation, differentiated and curiosity, and just in that small selection we can see the underlying power of snail mail. And with the continued growth of online sales fuelling ‘System 1’ emotions around this delivery mechanism - the question “Has the post come yet?” echoes frequently around my house with an air of anticipation - snail mail may actually be increasing in power. Further, by leveraging powerful concepts from behavioural economics such as reciprocity, social norms, commitment bias and chunking, to name but a few, we are in a position to influence behaviour and push average response rates higher than they are currently. Strategically, we have never been in a better position to 'behaviourally architect' the desired consumer take out, response and journey through a letter.

Read more from Crawford Hollingworth, Founder, The Behavioural Architects

[1] Direct Marketing Association, 2011 and 2012 (http://eleventygroup.com/site/report-direct-marketing-response-rates and www.magillreport.com/Email-Response-Rates-Pathetically-Low)

[2] CEP press release, dated 1st June 2013 for Dolan, P., and Metcalfe, R. ‘Neighbors, Knowledge and Nuggets: Two Natural Field Experiments on the Role of Incentives on Energy Conservation’ CEP Discussion Paper No. 1222, June 2013.

[3] Nicholas Carr, Wired ‘The web shatters focus, rewires brains’ Wired, May 2012 http://www.wired.com/magazine/2010/05/ff_nicholas_carr/

[4] Dolan, P., and Metcalfe, R. ‘Neighbors, Knowledge and Nuggets: Two Natural Field Experiments on the Role of Incentives on Energy Conservation’ CEP Discussion Paper No. 1222, June 2013. Quote taken from corresponding CEP press release, dated 1st June 2013.

[5] Daniel Kahneman, Thinking Fast and Slow, (Allen Lane) 2011

[6] Oppenheimer, D., ‘Consequences of Erudite Vernacular Utilized Irrespective of Utility: Problems of Using Long Words Needlessly’ 2005 Applied Cognitive Psychology 20: 139-156

[7] NYT, 2011 http://www.nytimes.com/2011/04/19/health/19mind.html?pagewanted=all&_r=0

[8] Feld et al “The effects of mailing design characteristics on direct mail campaign performance” International Journal of Research in Marketing, 2012

[9] Kanner, B. ‘Color schemes’ New York Magazine, 22-23, 1989, April 3

[10] Garner R. (2005) “Post-it note persuasion: a sticky influence” Journal of Consumer Psychology, 15(3): 230-7

[11] Bertrand, M., Karlan, D., Mullainathan, S., Shafir, E., and Zinman, J., "What's Advertising Content Worth? Evidence from a Consumer Credit Marketing Field Experiment”, Quarterly Journal of Economics, 2010, 125(1), pp. 263-305.

[12] FCA “ Encouraging consumers to claim redress: evidence from a field trial” April 2013

[13] ideas42: Using Nudges to Improve Health: Sticking to Statins http://www.ideas42.org/using-behavioral-nudges-to-improve-disease-management/

[14] Allcott, H. “Social norms and energy conservation” Journal of Public Economics, 2011

[15] Dolan, P., and Metcalfe, R. ‘Neighbors, Knowledge and Nuggets: Two Natural Field Experiments on the Role of Incentives on Energy Conservation’ CEP Discussion Paper No. 1222, June 2013. Quote taken from corresponding CEP press release, dated 1st June 2013.

[16] Behavioural Insights Team “Applying behavioural insights to fraud, error, debt” February 2012

Newsletter

Enjoy this? Get more.

Our monthly newsletter, The Edit, curates the very best of our latest content including articles, podcasts, video.

Become a member

Not a member yet?

Now it's time for you and your team to get involved. Get access to world-class events, exclusive publications, professional development, partner discounts and the chance to grow your network.